Canada BUL-1 - Alberta 2017-2025 free printable template

Show details

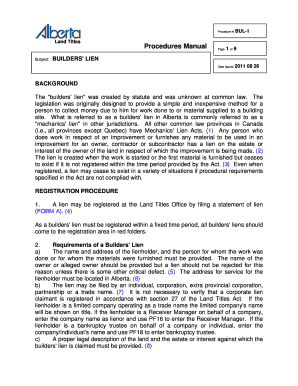

Procedure #Land Titles & SurveysSubject:Procedures ManualPageBUL11 of 10BUILDERS LIEN Date Issued2017 09 01BACKGROUND The “builders lien was created by statute and was unknown at common law. The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alberta procedures builders lien form

Edit your alberta procedures lien form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manual builders lien form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alberta manual builders online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bul 1 lien form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada BUL-1 - Alberta Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out canada manual lien form

How to fill out Canada BUL-1 - Alberta

01

Obtain the Canada BUL-1 form from the official Alberta government website or relevant authority.

02

Read the instructions carefully to understand the requirements and ensure you have all necessary information.

03

Fill in your personal details, including name, address, and other identifying information as prompted.

04

Provide the necessary information regarding your business operations, such as type of business and financial details.

05

Indicate the applicable tax information and include any required supporting documentation.

06

Review the completed form for accuracy and ensure all sections are filled out correctly.

07

Sign and date the form where required before submission.

08

Submit the form according to the indicated method, whether online or via physical mailing.

Who needs Canada BUL-1 - Alberta?

01

Businesses operating in Alberta that are required to report and remit certain taxes.

02

Individuals or entities that need to comply with the Alberta government tax regulations.

03

Any person or organization seeking to maintain compliance with Alberta tax laws.

Fill

alberta manual lien

: Try Risk Free

People Also Ask about

How does a construction lien work in Alberta?

A builders' lien gives contractors, subcontractors, suppliers, and labourers a way to collect money owed to them for labour and materials used to improve the land, including work on any structures on the land.

How do builders liens work in Alberta?

An Alberta Builders Lien is primarily used with delinquent customers, as leverage to get paid. When you file builders liens in Alberta you are registering your legal interest against the property where the work was done, or materials supplied.

How long is a builders lien good for in Alberta?

Subject to some exceptions, a lien for materials, services, or wages may be registered any time up to 45 days from the day the last materials, services, or wages were provided, or since the contract was abandoned. After those 45 days elapse, the lien expires.

How do I put a lien on a builder in Alberta?

To register an interest, fill out the form for the type of lien you wish to register and drop it off at a registry agent. Some interests must be registered within specific time frames. You should allow adequate lead time for processing by a registry agent if there are any legislative time limits for registration.

How long to file a builders lien in Alberta?

The contractor or supplier is then entitled to lien for the entire value of the contract by registering a lien within 45 days of the last day services or materials are provided, as opposed to filing within 45 days of each service that is provided or material that is furnished.

What is the builders lien legislation in Alberta?

Overview. On August 29, 2022, the changes to the Alberta Builders' Lien Act will take effect, making Alberta the third province in Canada to implement prompt payment and adjudication in its lien legislation. The new act will be called the Prompt Payment and Construction Lien Act (the PPCLA or the Act).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada BUL-1 - Alberta from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your Canada BUL-1 - Alberta into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I fill out Canada BUL-1 - Alberta on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your Canada BUL-1 - Alberta, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit Canada BUL-1 - Alberta on an Android device?

You can make any changes to PDF files, like Canada BUL-1 - Alberta, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is Canada BUL-1 - Alberta?

Canada BUL-1 - Alberta is a tax form used by businesses in Alberta to report their local tax obligations.

Who is required to file Canada BUL-1 - Alberta?

Businesses operating in Alberta that are registered for the tax are required to file Canada BUL-1 - Alberta.

How to fill out Canada BUL-1 - Alberta?

To fill out Canada BUL-1 - Alberta, gather required financial information, complete each section accurately, and ensure to include any applicable tax calculations before submission.

What is the purpose of Canada BUL-1 - Alberta?

The purpose of Canada BUL-1 - Alberta is to report and remit local taxes collected from customers to the Alberta government.

What information must be reported on Canada BUL-1 - Alberta?

The information that must be reported on Canada BUL-1 - Alberta includes total sales, amount of tax collected, any deductions, and other pertinent financial details.

Fill out your Canada BUL-1 - Alberta online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada BUL-1 - Alberta is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.